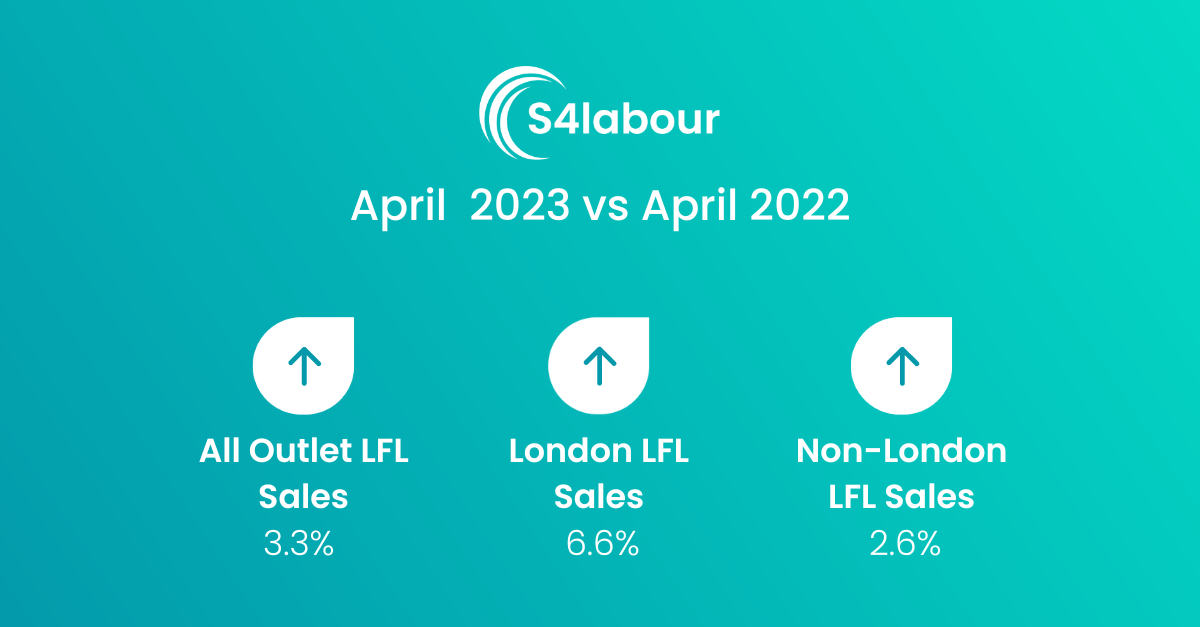

Hospitality grows sales in April, with a strong May on the cards

Hospitality like-for-like sales in April were up 3.3% against last year’s levels, according to the latest S4labour report.

Operators have been facing squeezed consumer confidence and an increase to national living wage levels over the month. Although April’s statistics are still below the rate of inflation, its rate is the second fastest so far this year, so this growth is good news for the sector.

London food sales were up 7.9% driving the capital’s overall uplift of 6.6%. Non-London was also led by food, with an increase of 4.5%.

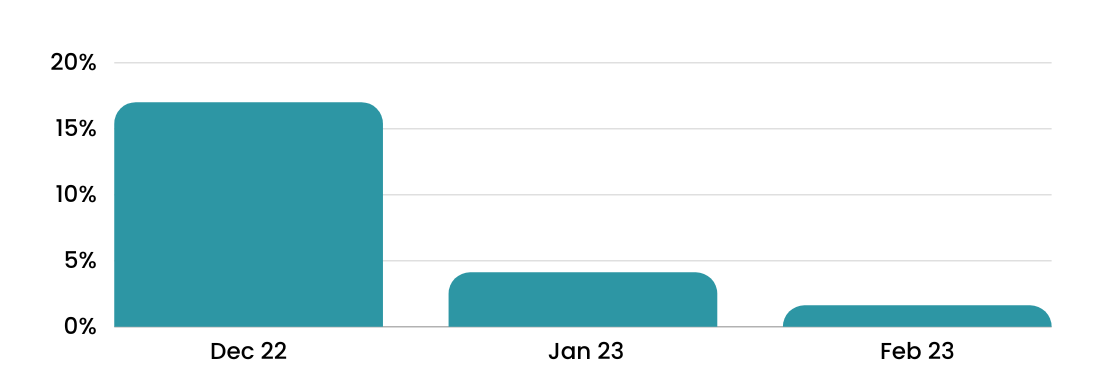

May will bring a big advantage and uplift in trading across its three bank holidays and warmer weather, with the Queen’s Jubilee weekend in 2022 bringing a 14% increase to week-on-week sales.

Richard Hartley, S4labour’s Chief Growth Officer, said: “Amidst what is a tough period for the industry, these figures are positive. With three bank holidays in May, operators across the country will have much stronger trading as consumer interest in eating and drinking out is set to spike, particularly if the weather is good.”